Brexit-related uncertainty, stressed and collapsing emerging market economies, and geopolitical tensions: These are the considerations factoring into the economic outlook for the upcoming year, and it’s a lot to take in.

Meanwhile, 2019 is rapidly coming to a close. Financial projections for 2020 are becoming more and more accurate, and you’re starting to assess what the year will look like for your enterprise. It’s stressful to sift through reports and economic outlooks, trying to glean any wisdom for the future that you can apply to your organization, not to even mention the dizzying confusion that comes with predicting the impacts of a presidential election. Don’t fret - we’re here to help.

We’ve combed the reports, consolidated the tables, and curated the data to make things easier on you. Below we’ve got the latest forecasts and tips to help you prepare for your enterprise’s most strategic year yet.

Global economic forecast

The International Monetary Fund (IMF) forecasts the rate of global growth to rise to 3.5 percent in 2020. Global trade has been and remains sluggish, especially in machinery and consumer durables. And the ongoing and intensifying trade war between the US and China is only making things worse - unless progress is made toward resolving differences, growth could continue to slow.

What this means for you

Expect the economic momentum from 2019 to continue gingerly into 2020. While global growth is projected to be subdued, the forecast is still positive. However, it’s important to know that the IMF considers this growth pickup to be precarious, based on uncontrollable variables and presumptions of stabilization in stressed emerging markets.

Make the most of these projections by taking note of what factors from the forecast are important to monitor for your organization’s financial health and focus your energies there. This is a good time to assess your technology and strategy by investing in solutions that can help you navigate your enterprise. If you’re still bogged down by manual processes, 2020 is the time to invest in a solution, such as the Oracle EPM Cloud or OneStream XF.

US economic forecast

The US economic forecast looks similar to the global economic forecast, but there are some key differences, and of course, the US has to factor in a presidential election. The IMF predicts the US economy to remain strong but that its growth will slow to 2 percent. Two rate cuts earlier in the year by the Federal Reserve have effectively stimulated the economy, and the Fed plans on one additional rate cut in the fourth quarter of 2019 to stimulate further growth and offset the drag from tariffs.

What this means for you

Strategy is the name of the game for 2020 - especially for those in the manufacturing industries. The manufacturing industry has been hit hardest by the US trade war with China, and as the trade war intensifies, the impacts will continue to grow. The service industry, meanwhile, has reported steady growth. Therefore, the outlook is different industry by industry, making thinking strategically about what priorities require your attention in 2020 of the utmost importance. Critically analyzing the integrity of everything that falls on your plate will be your key to success.

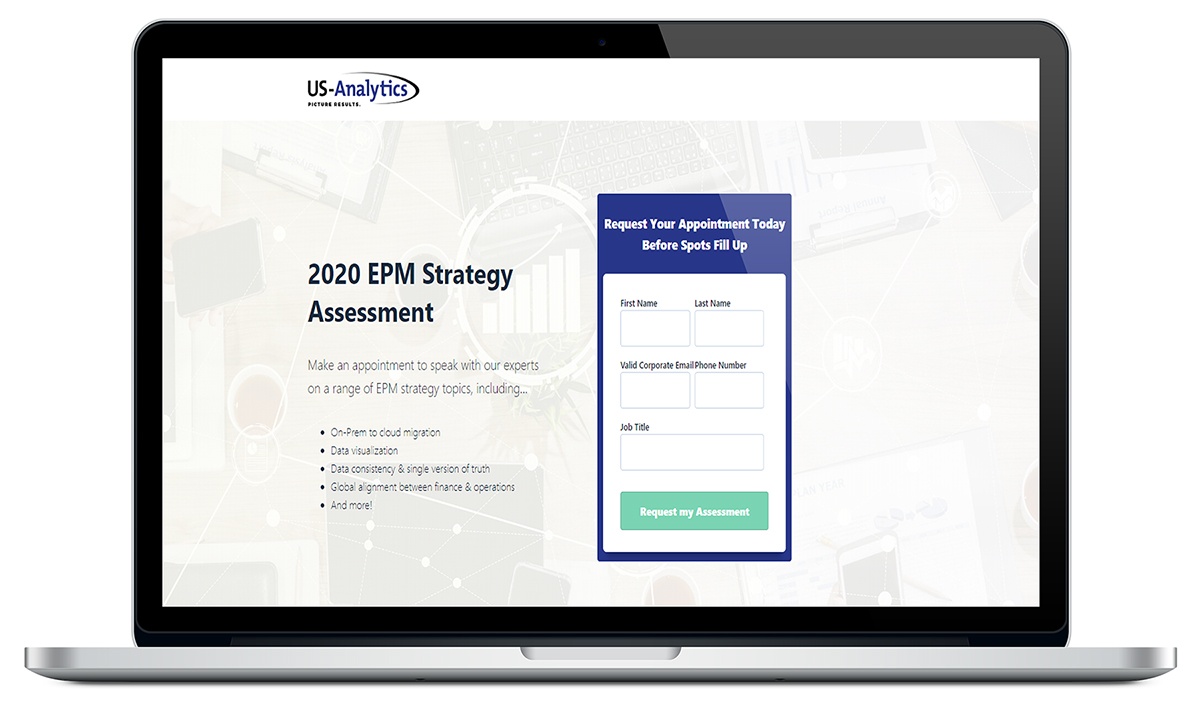

Whether you have an automation software or not, our team of seasoned experts can help you assess your finance and EPM strategy for 2020.

Conclusion

In this world of ever-increasing globalization, it’s important to understand how tightly global economies are interlinked. The growth projected for both the US and the global economy depends on factors largely out of our control - stressed emerging market economies, the fading of temporary fiscal drags, and the general financial market sentiment. Regardless of our ability to influence the outcomes, it’s important to understand the intricacies of the market in order to keep a clear focus on growth in 2020.

Interested in learning how your organization should strategize in 2020? Schedule your assessment today!