Choosing a solution to automate a process in your organization is easier said than done. There is an abundance of applications out there and you’re tasked with finding the right tool for your team to use.

When it comes to accounting tools to automate your account reconciliation process, there are several big names. In this blog post, we’ll compare two of those: BlackLine and Oracle’s Account Reconciliation tools — Oracle Account Reconciliation Manager (ARM) and Oracle’s Account Reconciliation Cloud Service (ARCS).

Option to Stay On-Prem or Move to the Cloud

Depending on your organization’s initiatives, you’re either looking for an account reconciliation solution that’s on-prem or leverages the cloud. Whether you want to stay on-prem or go to the cloud is up to your organization, but ensuring you completely understand the cloud will help you make this decision.

If you’re interested in a solution in the cloud, BlackLine or Oracle will work for you. However, BlackLine is purely a cloud-based solution. You’ll pay on a subscription model, based on your number of users over a typical three-year contract. Oracle’s cloud-based solution, ARCS, works on a similar pay scale with your tool hosted on the public Oracle EPM Cloud.

Unlike BlackLine, Oracle still offers an on-prem account reconciliation solution and will even release a new version by 2019. This on-prem account reconciliation tool, ARM, is a module of an even larger solution — Financial Close Management (FCM).

Functionality

Functionality is a huge factor in choosing an account reconciliation solution. Whether you go with BlackLine or an Oracle solution, the goal is the same: automating account reconciliations. The functionality does work a little different with each solution.

With BlackLine, you can choose solutions to help with your accounting needs: Financial Close Management (not to be confused with Oracle Financial Close Management), Intercompany Hub, Reconciliation Management, and Controls Assurance. Each of these solutions has several corresponding products. To get a full Financial Close Management solution, you must purchase the following six products:

- Account Reconciliations

- Task Management

- Transaction Matching

- Journal Entry

- Consolidation Integrity Manager

- Variance Analysis

If you’re simply looking for a reconciliation management solution, it only encompasses three products: Account Reconciliations, Transaction Matching, and Consolidation Integrity Manager.

The BlackLine account reconciliation product standardizes your reconciliation process, automatically adds new ERP accounts, create view-only records, and more. Transaction Matching matches and quickly reconciles transactions. Consolidation Integrity Manager automates the system-to-system reconciliation process. BlackLine also integrates with your ERP, Oracle, SAP, and NetSuite systems.

With Oracle account reconciliation tools, things are a little different. Rather than having separate products for things like account reconciliations and transaction matching, it’s included as a function of ARCS or ARM. Rather than having to purchase a separate product for transaction matching, you already have that built in to ARCS and ARM.

As stated above, if you choose an on-prem account reconciliation solution with Oracle, you'll need to look at Oracle Financial Close Management (FCM). Besides ARM, you also get two other modules — Close Manager and Supplemental Data Manager.

Features of Close Manager, include:

- Task scheduling and management to help you prioritize tasks.

- Pre-built dashboards to monitor progress financial close with common calendar views and tasks list views.

- Calendar and tasks lists that allows you to launch applications from within the calendar.

- Roll-forward feature that allows you to set up financial close calendars based on prior financial close.

Features of Supplemental Data Manager, include:

- Metadata and data integration with Hyperion Financial Management (HFM).

- Drilling back to/from HFM.

- Flexible attribute creation and formatting.

- Configurable frequencies and data collection periods with unlimited levels of approval.

- Filtering as well as ad-hoc reporting capabilities.

- Pre-built dashboards to monitor the status of data collection.

- Full integration with Smart View for simplified data entry.

Features of ARCS and ARM are very similar, for a more in-depth comparison, read the blog.

ARCS is updated monthly, like the rest of the Oracle EPM Cloud tools. Current features of ARCS, include:

- Reconciliation Compliance

- Tracking

- Collaboration and workflow

- Compliance-driven framework

- Comprehensive reconciliation formats

- Signoffs and approvals

- Transaction Matching

- Data optimization and normalization

- Flexible matching rules with configurable tolerances

- Interactive matching

- Management of discrepancies

- Balancing

- Integration

- Application integration (EPM and ERP)

- Easy integration with Oracle and other source systems

- Enterprise awareness

- Reconciliations

- Comprehensive reconciliation formats

- Automatic reconciliations

- Compliance-driven framework

- Collaboration and Workflow

- Task-driven processing

- Signoffs and approvals

- Compliance

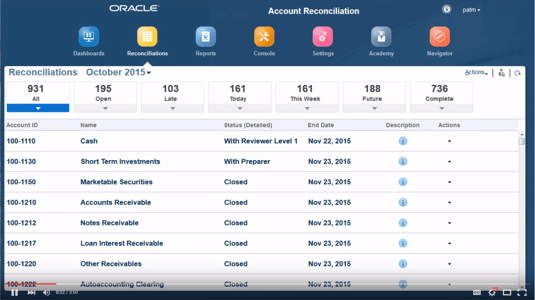

User Experience

Both Oracle and BlackLine tout their user-friendly platforms with the ability to generate graphs and reports with ease.

Each cloud-based solution is also available to use on your smartphone or tablet. Oracle tends to promote its user experience and simplified platform more than BlackLine. Oracle has a role-based, intuitive user interface as well as interactive dashboards and role-based tasks.

To get a better understanding of the user experience for each tool, you should request a demo.